Each other unsecured loans and family guarantee loans are often used to safety some expenses, whether you need more cash getting a large buy otherwise wanted to fund a house investment.

Every type of financing provides novel experts, so it is value evaluating unsecured loans against. house equity financing to see which will work good for you.

Popular features of Unsecured loans

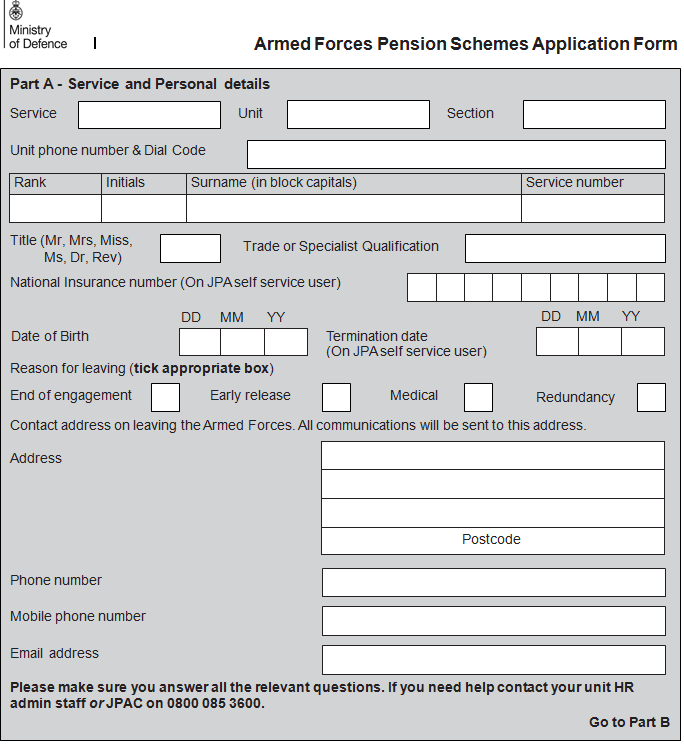

Of the two, signature loans be more straightforward. Your apply for a loan, your lender reviews the borrowing from the bank guidance and you may borrowing from the bank background prior to they is ount.

Typically unsecured

As a whole, unsecured loans tend to be unsecured. This means you don’t have to provide guarantee in their mind, although your lender you are going to request it if you need to use a particularly massive amount.

Personal loans are often used to safeguards very large expenditures, having financing amounts averaging up to $fifteen,000. Lenders usually have restrict restrictions to the fund.

As an instance, HFS now offers consumer loan amounts up to $25,000, with a further remark very important to people number past one to.

These types of fund along with apparently feature fixed rates having several in order to 60 days. Costs raise that have extended loan terminology.

Short acceptance

The brand new recognition techniques for personal finance now offers seemingly reasonable hassle having borrowers. Merely submit the mandatory paperwork, plus financial will feedback all the details. In many cases, you can buy approved a comparable go out, to make a personal loan a powerful way to manage emergency expenses.

Personal loans is actually mostly useful for large purchases or unforeseen expenses, or even to safeguards home improvements. Most people additionally use these to combine highest-appeal credit card debt, benefitting regarding the down pricing and possibly offered terms of personal money.

Top features of Home Security Financing

A house security financing is different from a personal loan in that you employ the latest guarantee gathered of your house (we.age. the degree of the mortgage you paid back) to hold the loan.

Secured which have security

Because you pay a home loan, your develop guarantee, that is basically the amount of your house that you’ve reduced off, otherwise commercially own. Homeowners are able to use that security due to the fact security during the a loan. These types of funds are known as second mortgages, and so they form nearly the same exact way mortgage loans would.

Financing number & terms

Extent you might borrow which have a property collateral financing try according to the guarantee you built up. For that reason, if you have built up, state, $100,000 when you look at the equity, you’d commercially have the ability to obtain up to $100,000.

Of course, there are many more activities at the office as well. The loan-to-worthy of (LTV) proportion of your own joint loans you will definitely reduce number your obtain, particularly when your residence features decrease when you look at the value. In the event your amount you borrowed on your financial in addition to collateral mortgage perform turn out so you’re able to more you reside currently well worth, it could be refuted. Rather, in case your matter you obtain carry out write a lesser LTV, you’d most likely advance costs.

Domestic security fund usually have stretched terms than just personal loans, probably interacting with up to 3 decades. Which makes fees a little more flexible, although it does mean you might be in debt to have a good stretched go out.

Comprehensive acceptance techniques

One of the drawbacks off a property equity loan ‘s the proven fact that its addressed given that another home loan. This means your property needs to be appraised and loan is certainly going through a full underwriting techniques in advance of it’s acknowledged. Oftentimes, it could take over a month for you to get acknowledged.

Most commonly known uses

House collateral fund are usually used in home improvements, buy higher expenses such training otherwise scientific debts, or even to consolidate obligations. Family security financing generally have lower interest levels than just private funds, definition they are a powerful way to pay back higher-attract expense.

The type of financing you select depends upon the benefits need. The financial needs of just one individual are very different considerably of those of another, and some brand of investment will make way more sense than others, so you should discover what works right for you.

Great things about unsecured loans

- No need to have property otherwise equity

- Punctual recognition

- More straightforward to go lower financing quantity

- Restricted risk to your private assets

Benefits associated with domestic collateral money

- Extended financing conditions

- Potentially higher loan amounts

- Straight down rates

- Potential for income tax deductions

Determining Ranging from Signature loans vs. Home Equity Finance

When you yourself have a property and you can large borrowing need, a home security financing is probably the best choice. Although not, for individuals who just need a injection of money, a personal bank loan will bring you the cash you desire in the place of the effort from an extended acceptance process. Simultaneously, if you don’t have a property or a huge amount of mainly based-right up security, a personal loan is your only option among them.

As the a member of HFS, you have access to expert advice during these credit choice and you will recommendations on which types of loan is perfect for your.