Calculating EPS growth is critical for investors since it can determine if the company is undervalued or overvalued. One of the methods that includes the EPS growth rate is the PEG ratio. Yes, it can talk about how much net profit a company has been earning, whether a company is generating higher yields, and whether one company is doing better than another in terms of earnings per share. But you should know that EPS alone cannot depict a great deal about a company’s financial health.

What Is a Good Earnings Per Share Ratio?

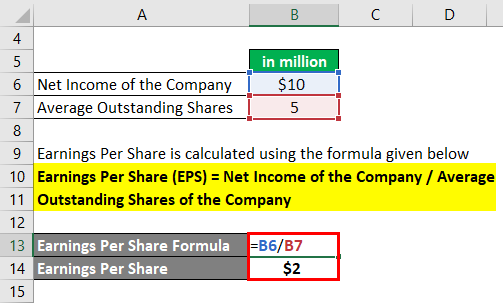

Earnings per share (EPS) is a company’s net income divided by its outstanding shares of common stock. Net income is the income available to all shareholders after a company’s costs and expenses are accounted for. Investors have a vast collection of financial data and indicators to use when selecting stocks, and one of the most common ratios used is earnings per share or EPS. But the EPS calculation can be tedious, especially if you aren’t sure of the formula. Likewise, a shrinking EPS figure might nonetheless lead to a price increase if analysts were expecting an even worse result.

MarketBeat Products

An accounting charge related to a past acquisition (often referred to as a ‘writedown’) could erase profits and lead to a reported net loss. A large, one-time, litigation settlement can lead to a short-term spike in expenses. If it loses $10 million with 10 million shares outstanding, basic loss per share is $1.00 even.

What Is the Difference Between Basic EPS and Diluted EPS?

The earning capability of a company determines the dividend payments and the value of its stocks in the market. Hence, the earnings per share (EPS) figure is very important for existing and prospective common shareholders. Remember that interest on bonds payable is a tax-deductible expense while dividends on preferred shares are not.

- Basic EPS uses net income divided by total outstanding shares, but the total outstanding shares number is different from the total potential outstanding shares.

- The earnings per share calculation is a valuation metric that allows investors to look at a company’s profits per share.

- Investors typically compare the EPS of two or more companies within the same industry to get a sense of how one company is performing relative to its peers.

- EPS is crucial for investors as it helps gauge the financial health and profitability of a company.

- Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

- The treasury stock method (TSM) requires the market share price, which we’ll assume is $40.00 as of the latest market closing date.

As a result, some of the data will be based on actual figures and some will be based on projections. Most P/E ratios are calculated using the trailing EPS because it represents what actually happened, and not what might be. On the other hand, while the figure is accurate, the trailing EPS is often considered old news. In fact, a trailing EPS is calculated using the previous four quarters of earnings. Choose the stock you want to analyze from the search bar (which will populate based on the ticker) or enter the financial data to explore from past years or quarters. For example, Tesla’s most recent report announced $12.556 billion in net income.

Basic EPS and diluted EPS are used to measure the profitability of a company. The amount earned by each share of common stock is represented as basic earnings per share in the company income statement. The higher the company’s basic earnings per share, the greater the return on investment and profit common stockholders make. On the other hand, diluted earnings per share represent the profit that would be earned by each share of common stock if all dilutive securities were converted into common stock.

But the outstanding options — whether in the money or not — do not affect diluted share count. Again, they are anti-dilutive; if they were added to the diluted share count, loss per share would improve slightly, to $0.95. The Earnings Per Share (EPS) is the ratio between the net profit generated by a company and the total number of common shares outstanding.

Just as a share price on its own doesn’t make a stock price ‘cheap’ or ‘expensive’, earnings per share on its own doesn’t prove fundamental value. And so diluted share count equals 10 million shares plus another 500,000 (the 1 million shares underlying options, less than 500,000 theoretically repurchased). Diluted EPS is calculated by dividing the $10 million in net profit by the 10.5 million in diluted shares, giving a result of 95 cents. EPS is typically used by investors and analysts to gauge the financial strength of a company. In fact, it is sometimes known as the bottom line where a firm’s worth is concerned, both literally (as the last item on the income statement) and figuratively.

Earnings or profits are the money left after covering all expenses related to business operation, all money needed to produce the goods sold, taxes, and any interests from debts. In a nutshell, earnings are the money left after paying for the operations and any other financial obligation. Calculate the portion of a company’s profit allocation to each share of common stock. Earnings per share serve provide visability of a specific company’s profitability. Earnings per share are almost always analyzed relative to a company’s share price.

It is the figure most commonly reported in the financial media and is also the simplest definition of EPS. Since we now have the beginning and ending number of common shares outstanding, the next step is to calculate the weighted average shares outstanding. Pro forma earnings per share is a measure of a company’s profitability that excludes one-time or non-recurring last-in first-out lifo method in a perpetual inventory system items. This allows investors to get a more accurate picture of the company’s true profitability. Reported earnings per share, on the other hand, includes all items that are reported on the income statement. Basic earnings per share are recorded in a company’s income statement and are quite important for assessing the performance of firms with just common shares.