Family equity is one of the most versatile and you can worthwhile economic gadgets that you can enjoys in the the discretion. To properly make use of it, and avoid it performing facing your, an extensive understanding of home guarantee is needed. Of trying to determine what the ideal rates is for a household collateral financing inside the Maryland, you must be able to assess elements which go towards starting such pricing. To start, we will consider what exactly domestic collateral is so that comprehension is got when wearing down just how home equity mortgage rates inside the Maryland really works.

What’s Household Equity?

In short, domestic guarantee is the difference between the modern market price from your home together with equilibrium kept on the mortgage. Consequently since you build your home loan repayments, the latest guarantee of your property expands. Domestic equity may also increase if the value of your home expands. The actual value of domestic guarantee will come when it is made use of since the a good creditable advantage that allow you to secure good one-day financing. Rather, you are able to your property collateral as a credit line, titled a HELOC payday loans Jewett City.

Just how Family Security Loans Really works

Family security finance performs by using the guarantee on the domestic because guarantee into financing. These types of finance are supplied in one lump sum payment and therefore are repaid into repaired installment payments. The eye costs are typically much lower than simply that of antique finance such playing cards. When you find yourself a house guarantee loan when you look at the Maryland can be an incredibly advantageous endeavor, it can be a risk that may place the possession out of your residence at risk in the event that you standard on your loan money. You are along with prone to obtaining worth of your household disappear which means you’d owe more than the brand new appraised value of your house.

Just how House Equity Lines of credit (HELOC) Work

Property collateral personal line of credit or HELOC works as a good line of credit one to enables you to borrow money, such as a credit card, which have a varying interest rate. HELOCs differ from normal family equity loans the help of its changing monthly installments therefore the power to remove only a small amount or up to you want. The maximum regarding credit is dependent on the quantity that collateral in your home is worth. HELOCs is actually popular for those who wanted a line of credit available in lieu of an individual financing.

Questioned Costs

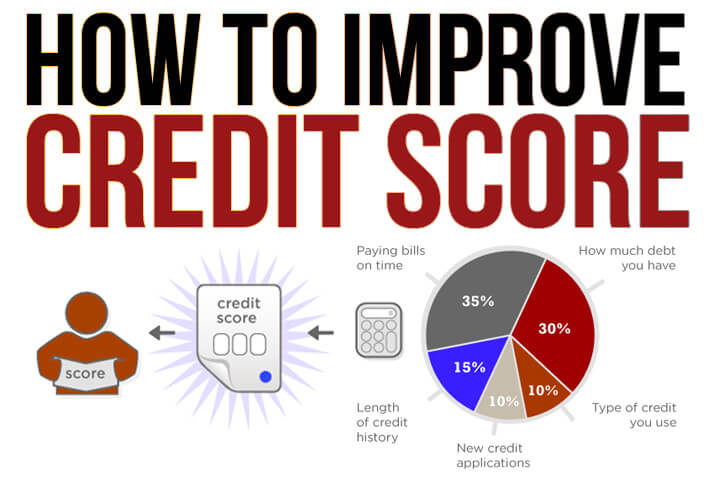

Obviously, these fund has standards for these seeking take-out a family collateral mortgage inside Maryland. Many lenders require a credit score to get 630 or more however, so you can qualify for an educated cost, a credit history more than 700 is preferred. Additionally you need to have a financial obligation-to-income proportion off just about 43% and you will a verifiable source of income. Along with, the new equity of your home must be higher than 20% of your house’s full value. The modern average speed having an effective HELOC household collateral loan into the are 6.51% having a variety of 5.27% nine.14% while the mediocre rate having property guarantee loan are seven.01% with various 6.45% -8.16%.

Federal Hills’ Domestic Collateral Specialist Services

Household collateral the most appealing aspects of house possession, exactly what happens when you are prevented off opening your home security because of a compulsory re-finance? Federal Mountain Home loan keeps a reply with our Home Guarantee Professional Service. Today, you need access your equity without the need to refinance otherwise replace your newest financial price. On top of that, you can acquire to love no away-of-pocket closing costs no antique appraisal will become necessary for the majority cases. I to allow one to use your house security and you will control your home financing with Federal Hill Mortgage loans Family Equity Pro Solution.

Get the very best Household Equity Loan Cost during the Maryland

If you’re looking to have a home loan company and you can agent so you’re able to make it easier to keep the low family equity mortgage rates from inside the Maryland, your research ends which have Government Slope Financial. All of our masters will proficiently guide you from domestic guarantee process and ensure you will get the best from your house. Incorporate today to observe how we could make your home security benefit you!